WHAT IS

Fraud?

Fraud is a deliberate act of deception, typically carried out for financial gain or to secure some unfair or unlawful advantage. It involves intentionally misrepresenting facts, information, or intentions to deceive others. Fraud can take various forms and occur in different contexts, including financial transactions, business operations, personal interactions, and more.

WHAT IS

Fraud risk?

Fraud risk refers to the potential that an individual, organisation, or system might engage in deceptive or dishonest activities to achieve financial gain or other benefits. It involves the possibility of misrepresenting information, manipulating transactions, or exploiting vulnerabilities to deceive others. Organisations often assess and manage fraud risk to prevent or mitigate the impact of fraudulent activities.

WHAT IS A

Fraud Risk Assessment?

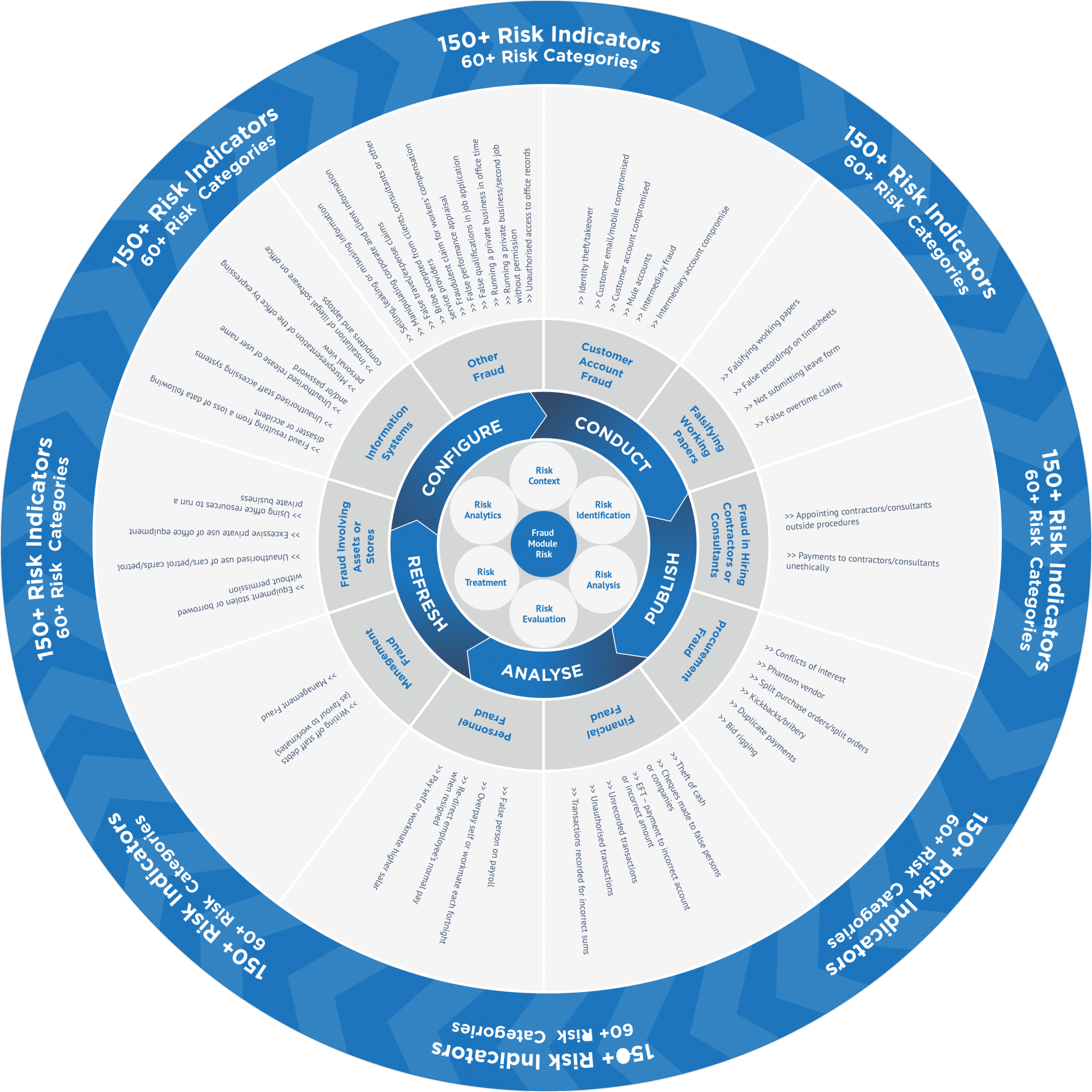

A Fraud Risk Assessment is a systematic process that involves identifying, evaluating, and understanding the potential risks and vulnerabilities within an organisation that could lead to fraudulent activities. It typically involves analysing various aspects of the organisation's operations, processes, and systems to determine where weaknesses or opportunities for fraud might exist. The goal of a Fraud Risk Assessment is to proactively identify and address areas where fraud is more likely to occur, enabling the organisation to implement controls and measures to prevent, detect, and respond to fraudulent activities effectively.

WHO MUST CONDUCT A

Fraud Risk Assessment?

Fraud Risk Assessments are important for a wide range of organisations, regardless of their size or industry. Any entity that handles financial transactions, sensitive information, or valuable assets can benefit from conducting a Fraud Risk Assessment, including:

WHAT RISK FACTORS SHOULD BE CONSIDERED WHEN CONDUCTING

Fraud Risk Assessments?

When conducting a fraud risk assessment, it's important to consider a wide range of risk factors that could contribute to potential fraudulent activities, some key risk factors to consider include:

Remember that the specific risk factors can vary depending on the nature of your organisation, industry, and operating environment. It's essential to conduct a thorough assessment tailored to your organisation's unique circumstances to effectively identify and mitigate fraud risks.

Download our Fraud Risk Fact Sheet

Download our Fraud Risk and Control Module Brochure

Click on the button to download the Fraud Risk and Control Module Brochure

COMPLETE THE FORM

Access the Content Module Overview

The content module overview provides an introduction to fraud and outlines the necessity and methods for its implementation.

Additionally, it presents the Arctic Intelligence Risk Assessment Platform, highlighting its potential advantages for your business.

Request your free copy now!