Designated services offered by

Real Estate Professionals

Under the AML/CTF Amendment Bill 2024, specific real estate services will be designated as covered activities and will be subject to AML/CTF obligations. These services include:

If your business provides any of these services, it will be subject to AML/CTF obligations.

Money Laundering and Terrorism Financing (ML/TF)

Risks in Real Estate

The real estate sector faces significant ML/TF risks, including:

- Use of third parties to conduct transactions, masking the true buyer or seller

- Manipulating property values, either inflating or undervaluing properties to move illicit funds

- Structuring cash payments to avoid detection while purchasing real estate

- Complex corporate structures and multiple accounts used to obscure ownership and transaction flows

- Leasing properties to tenants who pay rent with illicit funds

- Acquiring properties with criminal proceeds to serve as bases for further illegal activity

To comply with the AML/CTF Act by 1 July 2026, real estate businesses must conduct a thorough ML/TF risk assessment to identify, mitigate, and manage risks effectively.

For more information on the ML/TF risks faced by Real Estate Professionals click here.

AML/CTF Programs and Policies

In addition to designing, executing and maintaining a money laundering, terrorism financing and proliferation financing (ML/TF/PF) risk assessment reporting entities are expected to implement AML/CTF policies that are both appropriate and proportionate to the identified risks, in order to mitigate and manage these risks.

AML/CTF

Programs and Policies

In addition to designing, executing and maintaining a money laundering, terrorism financing and proliferation financing (ML/TF/PF) risk assessment reporting entities are expected to implement AML/CTF policies that are both appropriate and proportionate to the identified risks, in order to mitigate and manage these risks.

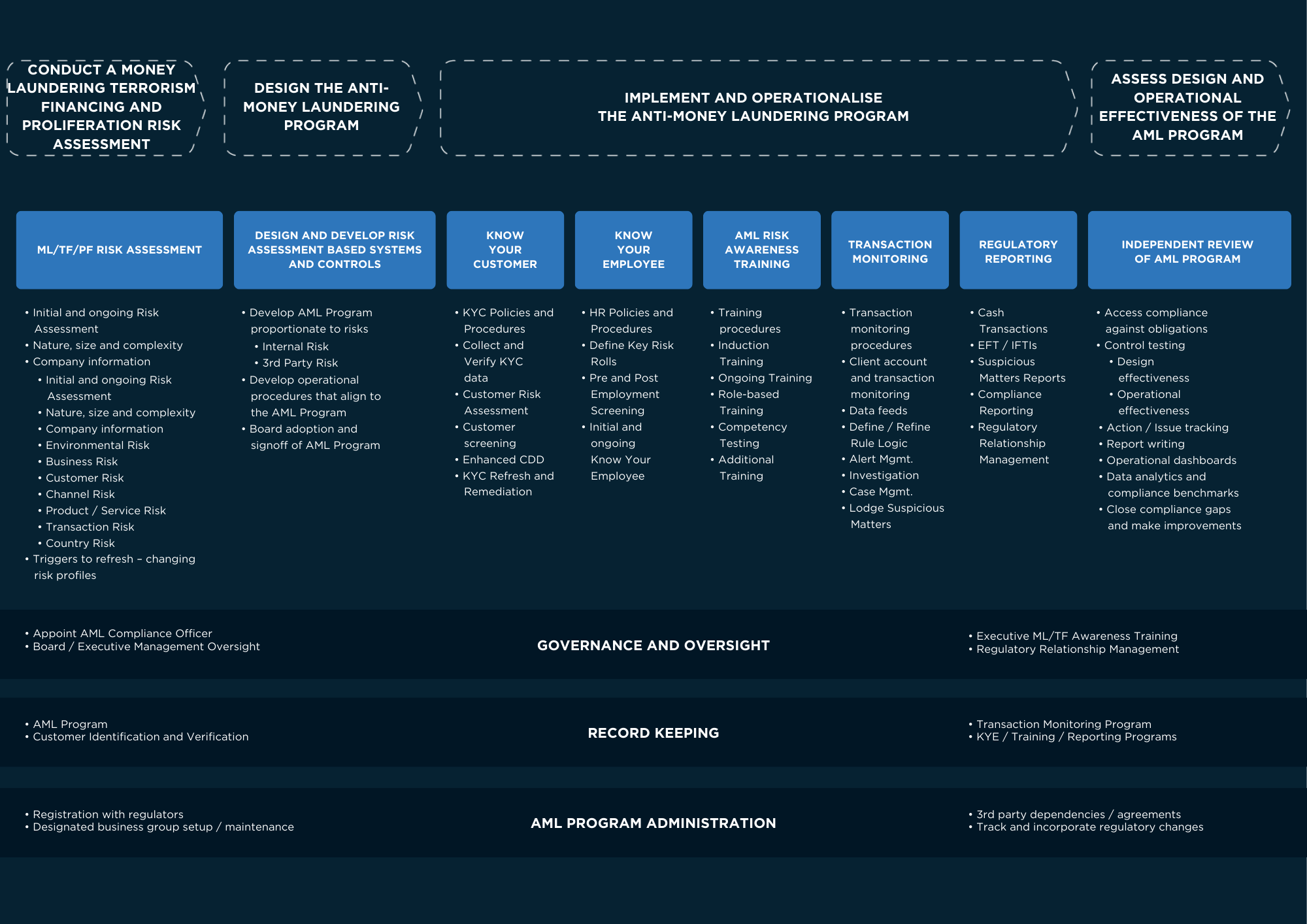

The diagram below outlines at a high-level the other key pillars of an AML/CTF Program:

In addition to designing, executing and maintaining a money laundering, terrorism financing and proliferation financing (ML/TF/PF) risk assessment reporting entities are expected to implement AML/CTF policies that are both appropriate and proportionate to the identified risks, in order to mitigate and manage these risks.

In focus

Blogs

In focus

Whitepapers

Anti-Money Laundering 101: What do Australian Real Estate Professionals need to know about the AML/CTF Amendment Act 2024 and how can they start to prepare to comply?

AML/CTF compliance for real estate professionals.

What is the role of Real Estate Agents in preventing money laundering in high-value transactions?

Real estate agents play a crucial role in preventing money laundering in high-value property transactions through due diligence, compliance, and risk assessment measures.

Real estate and AML/CTF: Legislative efforts to combat illicit investments

Examining legislative efforts to strengthen AML/CTF regulations in real estate, targeting illicit investments, enhancing transparency, enforcing compliance, and mitigating financial crime risks in the sector.