Designated services offered by

Virtual Asset Service Providers

Under the AML/CTF Amendment Bill 2024, specific services provided by Virtual Asset Service Providers (VASPs) will be designated as covered activities and will be subject to AML/CTF obligations. These services include:

If your business provides any of these services, it will be subject to AML/CTF obligations.

Money Laundering and Terrorism Financing (ML/TF)

Risks in the VASP sector

Virtual Asset Service Providers face significant ML/TF risks, including:

- Anonymity and Pseudonymity – Virtual assets allow users to transact without revealing their real identities, making it difficult to trace illicit funds

- Rapid Cross-Border Transfers – Cryptocurrencies enable instant international transactions, bypassing traditional banking controls and regulatory oversight

- Use of Mixing and Tumbling Services – Criminals launder funds by obfuscating transaction trails through cryptocurrency mixers and tumblers

- Exploitation of Peer-to-Peer (P2P) Exchanges – Direct trading between individuals can occur without regulatory oversight, increasing the risk of illicit activity

- Obscured Beneficial Ownership – Virtual wallets, decentralised finance (DeFi) platforms, and layered transactions make it difficult to identify the true owner of funds

- Terrorist Financing Through Crypto Donations – Extremist groups use virtual assets to receive and distribute funds anonymously

- Sanctions Evasion and Illicit Trade – Cryptocurrencies are used to circumvent financial sanctions and facilitate illegal goods transactions on dark web marketplaces

- Crypto ATMs for Money Laundering – Physical kiosks enable anonymous cash-to-crypto conversions, allowing criminals to integrate illicit cash into the financial system

- Fraudulent Initial Coin Offerings (ICOs) and Token Sales – Criminals create fake crypto projects to collect funds from unsuspecting investors and launder money

- Limited AML Controls in Decentralised Finance (DeFi) – DeFi platforms operate without centralised oversight, making it difficult to enforce AML/CTF regulations

To comply with the AML/CTF Act by 1 July 2026, virtual asset service providers must conduct a thorough ML/TF risk assessment to identify, mitigate, and manage risks effectively.

For more information on the ML/TF risks faced by virtual asset service providers ,click here.

AML/CTF

Programs and Policies

In addition to designing, executing and maintaining a money laundering, terrorism financing and proliferation financing (ML/TF/PF) risk assessment reporting entities are expected to implement AML/CTF policies that are both appropriate and proportionate to the identified risks, in order to mitigate and manage these risks.

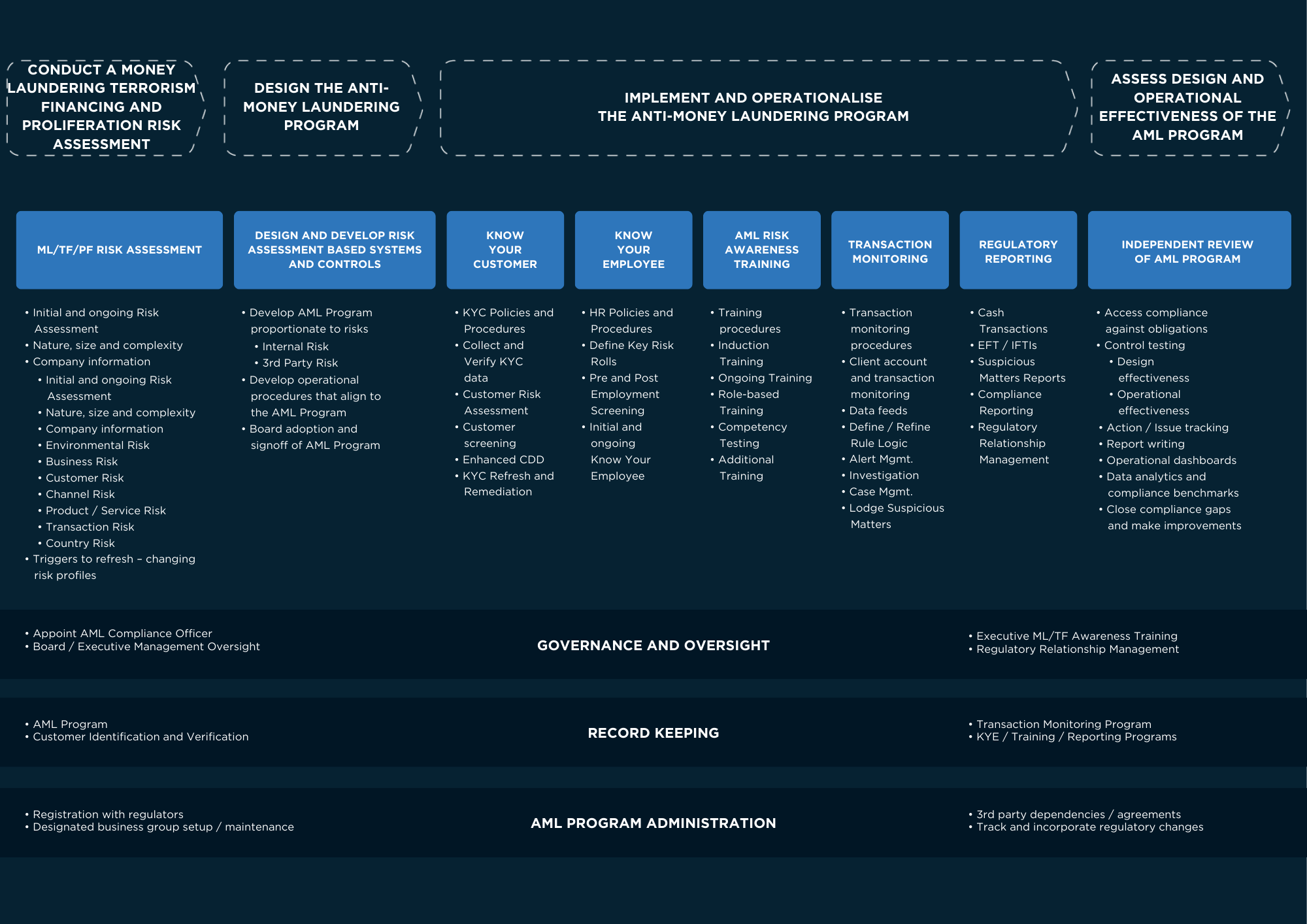

The diagram below outlines at a high-level the other key pillars of an AML/CTF Program:

In addition to designing, executing and maintaining a money laundering, terrorism financing and proliferation financing (ML/TF/PF) risk assessment reporting entities are expected to implement AML/CTF policies that are both appropriate and proportionate to the identified risks, in order to mitigate and manage these risks.

In focus

Blogs

In focus

Whitepapers

Anti-Money Laundering 101: What do Australian Virtual Asset Service Providers need to know about the AML/CTF Amendment Act 2024 and how can they start to prepare to comply?

Virtual asset providers must prepare for compliance with these requirements.

Cryptocurrency and AML: Global approaches to regulating Virtual Asset Service Providers (VASPs)

Regulations on cryptocurrency and AML focus on Virtual Asset Service Providers (VASPs), requiring compliance measures to prevent financial crimes, enhance transparency, and mitigate money laundering risks in digital asset transactions.

How do organised criminals exploit virtual asset service providers to launder the proceeds of their Crimes and what can you do to prevent it?

Criminals exploit virtual asset providers for money laundering; implementing strong compliance, monitoring, and due diligence measures can help prevent illicit activity.

Case Studies: How do organised criminals exploit virtual asset service providers to launder the proceeds of their crimes and what can you do to prevent this happening in your business?

Strong compliance prevents exploitation through digital assets.