WHAT IS

Market Abuse?

Market abuse refers to a range of unethical and illegal activities that can undermine the integrity of financial markets. These activities typically involve manipulative or deceptive practices intended to distort market prices, mislead other market participants, or unfairly exploit non-public information for personal or financial gain. Market abuse undermines the fairness and efficiency of financial markets, and it is targeted by regulatory authorities through a combination of surveillance, enforcement, and penalties to maintain market integrity.

WHAT IS

Market Abuse risk?

Market abuse risk refers to the potential for certain actions or behaviors by market participants to undermine the integrity, fairness, and transparency of financial markets. These risks arise from practices that distort the price discovery process, deceive other market participants, or otherwise manipulate the market for personal or institutional gain. Market abuse can take various forms, including insider trading, market manipulation, and the dissemination of false or misleading information.

Insider Trading

Insider trading occurs when someone with access to material, non-public material information about a company (such as executives, employees, or other insiders) uses that information to buy or sell the company’s securities before the information is made public. This gives the insider an unfair advantage over other investors who do not have access to this information.

Market Manipulation

Market manipulation involves deliberately misleading or deceiving market participants to influence the price or trading volume of a security, commodity, or other financial instrument. Examples include, pump and dump schemes, spoofing and layering schemes, and wash trading.

Dissemination of false or misleading information

Dissemination of false or misleading information refers to the intentional or reckless distribution of inaccurate, deceptive, or incomplete information in order to influence market participants' decisions, distort market prices, or otherwise manipulate the financial markets.

WHAT IS A

Market Abuse Risk Assessment?

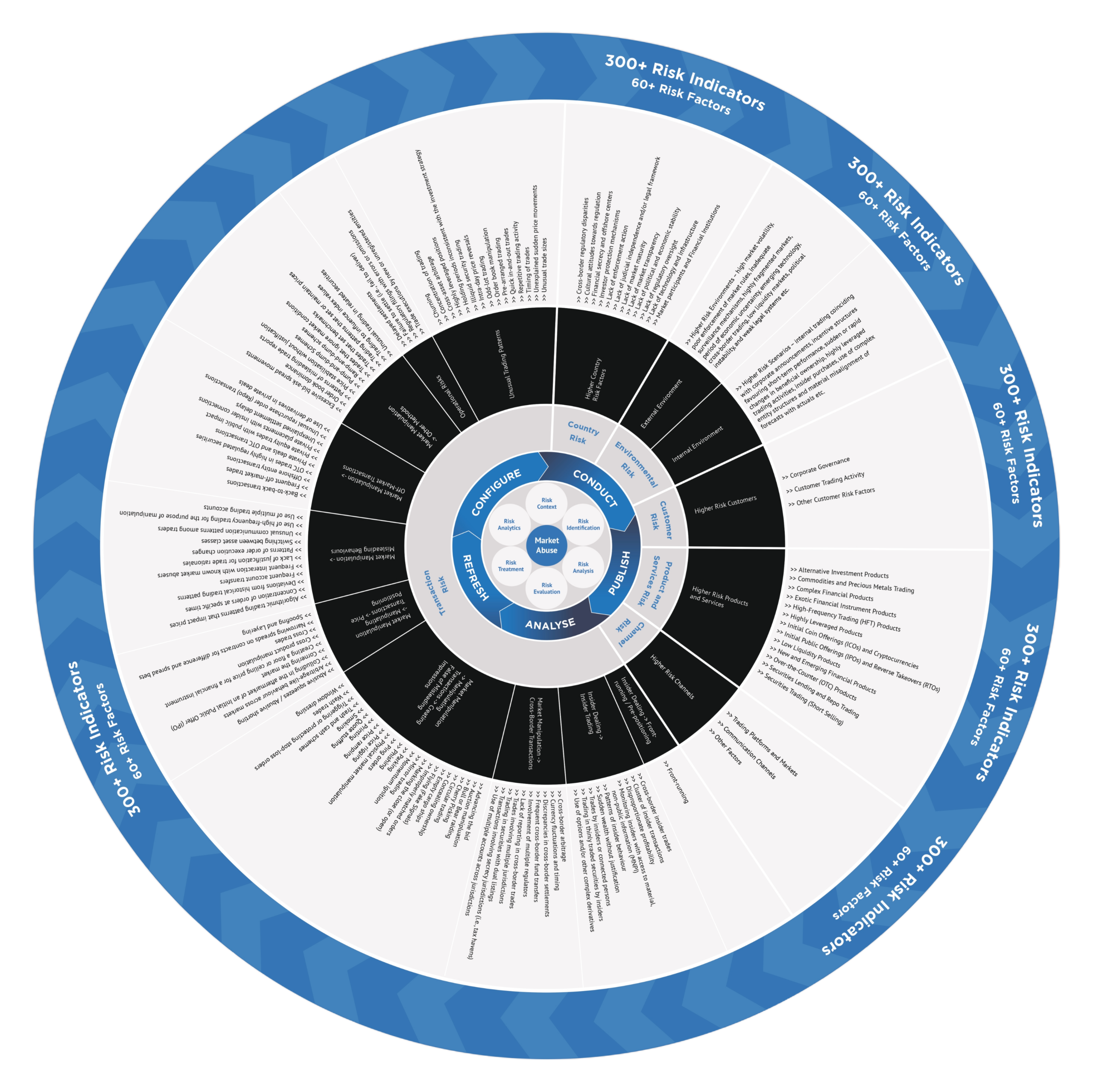

A Market Abuse Risk Assessment (MARA) is a structured process undertaken by financial institutions, regulatory bodies, or other market participants to identify, evaluate, and mitigate the risks associated with market abuse within their operations or the markets they oversee. The goal of the assessment is to ensure that appropriate controls, policies, and procedures are in place to prevent, detect, and respond to activities that could constitute market abuse, such as insider trading, market manipulation, and other unethical or illegal trading behaviours.

The primary purpose of a market abuse risk assessment is to protect the integrity of the financial markets by proactively identifying and mitigating risks that could lead to unethical or illegal trading behaviours. A market abuse risk assessment is a crucial tool for financial institutions to safeguard against the risks of market abuse, ensuring compliance, maintaining market integrity, and protecting both the institution and its clients from the adverse effects of unethical trading practices.

A market abuse risk assessment is a critical tool for financial institutions and regulators to maintain the integrity of financial markets. By systematically identifying, evaluating, and managing risks, organisations can protect themselves and the broader market from the damaging effects of market abuse.

WHAT ARE

Regulators doing to prevent Market Abuse?

WHICH

Industry sectors must conduct a Market Abuse Risk Assessment?

Market abuse risk assessments are particularly relevant and necessary in industry sectors that are closely involved with financial markets, where the risk of insider trading, market manipulation, and other forms of market abuse is significant. Market abuse risk assessments help maintain market integrity, ensure compliance with regulations, and protect the reputation and financial stability of the organisations involved.

Here are the key industry sectors that typically must or should conduct a market abuse risk assessment:

WHAT ARE THE

Key components of a Market Abuse Risk Assessment?

Identification and Evaluation of Risk Factors

Evaluation of Controls

Risk Scoring and Prioritization

Mitigation Strategies

Ongoing Monitoring and Review

What are the

The key objectives of conducting a Market Abuse Risk Assessment?

The main objectives of a market abuse risk assessment include:

A market abuse risk assessment is a critical tool for financial institutions and regulators to maintain the integrity of financial markets. By systematically identifying, evaluating, and managing risks, organisations can protect themselves and the broader market from the damaging effects of market abuse.

WHAT ARE

The benefits of conducting a Market Abuse Risk Assessment?

1. Proactive Risk Management: Identifies potential risks before they become significant issues, allowing for timely intervention.

2. Enhanced Regultory Compliance: Ensuring that the institution adheres to all relevant regulations and guidelines, thus avoiding legal penalties and reputational damage.

3. Improved Market Integrity: Contributing to the overall health and trustworthiness of financial markets by reducing the likelihood of market abuse.

4. Reduced Financial and Reputational Risk: Minimizing the risk of financial losses and reputational harm associated with market abuse incidents.

5. Informed Decision-Making: Providing senior management with the information needed to make informed decisions about risk management and resource allocation.

6. Market Integrity: Contributes to the overall health and fairness of financial markets by preventing abusive practices.

7. Reputational Protection: Protects the institution’s reputation by demonstrating a commitment to ethical conduct and market integrity.

WHAT ARE

The steps to conducting a Market Abuse Risk Assessment?

WHO ARE

The key stakeholders to engage in a Market Abuse Risk Assessment?

Market abuse risk assessments are best conducted when taking in to consideration perspectives from different stakeholder groups, including those listed below, which ensures a more comprehensive and effectivness assessment, based on a thorough understanding of the potential risks and mitigating control environment.

Download our Market Abuse Fact Sheet

Download our Market Abuse Module Brochure

Click on the button to download the Market Abuse Risk and Control Module Brochure

COMPLETE THE FORM

Access the Content Module Overview

The content module overview provides an introduction to market abuse, and outlines the necessity and methods for its implementation.

Additionally, it presents the Arctic Intelligence Risk Assessment Platform, highlighting its potential advantages for your business.

Request your free copy now!