WHAT ARE

Money Laundering and Terrorism Financing laws?

AML/CTF laws apply to millions of businesses in over 200 countries and over 30 different industries within the financial services, gaming, gatekeeper professions and high-value dealers sectors. AML/CTF laws are risk-based meaning they require all regulated businesses to conduct an ML/TF risk assessment to identify and assess their vulnerabilities to their businesses being used to facilitate ML/TF and build an appropriate and proportionate control framework.

WHAT IS

Money Laundering and Terrorism Financing risk?

Money Laundering and Terrorism Financing risk refers to the likelihood and potential impact of regulated businesses being inadvertently involved in or used as conduits for money laundering or terrorism financing activities. These risks arise from the possibility that illicitly obtained funds could flow through a legitimate financial system or business, making them appear lawful.

WHAT IS A

Money Laundering and Terrorism Financing Risk Assessment?

A Money Laundering and Terrorism Financing risk assessment is a systematic evaluation conducted by regulated businesses or regulatory authorities to identify and analyse the potential risks of unwittingly facilitating ML/TF and the process to design, implement and maintain an appropriate and proportionate control framework relative to the risk.

The ML/TF risk assessment involves examining various factors, such as customer profiles, transaction patterns, geographic locations, and the nature of products or services offered, to determine the likelihood and potential impact of these risks occurring. The goal is to develop strategies and measures to mitigate these risks effectively and ensure compliance with AML/CTF laws.

WHO MUST CONDUCT A

Money Laundering and Terrorism Financing Risk Assessment?

Financial Institutions

Other Sectors

Asset managers, hedge funds and fund managers

Banks, building societies, credit unions & mutuals

Cash in transit and safety deposit box providers

Corporate finance and private equity

Cryptocurrency and digital currency exchanges

FinTechs

Foreign exchange and MSBs (money remitters)

Financial planners

Insurance companies

Investment managers

Leasing and hire purchase financing businesses

Non-bank financial institutions

Payment processing services

Stockbrokers

Superannuation, retirement and pensions

Bookmakers and betting agencies

Casinos

Physical gaming venues

Online gambling

Accountants and bookkeepers

Lawyers and conveyancers

Trust & company service providers (TCSPs)

Real estate professionals

Antique and fine art dealers

Auctioneers and brokers

Bullion & precious stone dealers & jewellers

Motorised vehicle dealers (cars, boats, planes)

Luxury goods dealers

Pawnbrokers & second hand dealers

Other sectors (e.g. marijuana businesses, NGOs)

The industry sectors required to comply with AML/CTF laws may vary from country to country.

Financial Institutions

Asset managers, hedge funds and fund managers

Banks, building societies, credit unions & mutuals

Cash in transit and safety deposit box providers

Corporate finance and private equity

Cryptocurrency and digital currency exchanges

FinTechs

Foreign exchange and MSBs (money remitters)

Financial planners

Insurance companies

Investment managers

Leasing and hire purchase financing businesses

Non-bank financial institutions

Payment processing services

Stockbrokers

Superannuation, retirement and pensions

Other Sectors

Bookmakers and betting agencies

Casinos

Physical gaming venues

Online gambling

Accountants and bookkeepers

Lawyers and conveyancers

Trust & company service providers (TCSPs)

Real estate professionals

Antique and fine art dealers

Auctioneers and brokers

Bullion & precious stone dealers & jewellers

Motorised vehicle dealers (cars, boats, planes)

Luxury goods dealers

Pawnbrokers & second hand dealers

Other sectors (e.g. marijuana businesses, NGOs)

The industry sectors required to comply with AML/CTF laws may vary from country to country.

WHY SHOULD I CONDUCT A

Money Laundering and Terrorism Financing Risk Assessment?

WHAT RISK FACTORS SHOULD I CONSIDER IN A

Money Laundering and Terrorism Financing Risk Assessment?

- Customer Profiles: Assess the risk associated with different types of customers, including politically exposed persons (PEPs), higher risk industries, and customers from higher risk jurisdictions.

- Customer Behaviour: Look for unusual patterns of behaviour, such as sudden changes in transaction volume, inconsistent customer information, or mismatched activity profiles.

- Source of Funds: Investigate the origin of funds, especially for higher value transactions. Determine if the source of funds aligns with the customer's profile and business activities.

- Products and Services: Determine the risk level of the products and services you offer, as some might be more susceptible to abuse than others (e.g., prepaid cards, digital currencies, money remittance).

- Delivery Channels: Consider the risk associated with different channels through which transactions are conducted, including online platforms, mobile apps, and in-person interactions.

- Third-Party Relationships: Evaluate the risk posed by relationships with third parties, such as agents, distributors, or intermediaries, as they can introduce additional risk factors.

- Transaction Types: Analyse the risk posed by various transaction types, such as large or complex transactions, frequent transfers, and non-standard payment methods.

- Geographic Locations: Evaluate the risk associated with transactions involving countries or regions known for money laundering or terrorism financing activities.

- Higher Risk Industries: Assess the risk of dealing with industries prone to money laundering and terrorism financing, such as gambling, real estate, and cash-intensive businesses.

- Employee Awareness: Evaluate the level of employee training and awareness regarding ML/TF risks.

- Record Keeping: Consider the completeness and accuracy of your record-keeping practices, as inadequate documentation can hinder detection and investigation efforts.

- Technological Vulnerabilities: Examine potential weaknesses in your technology systems that could be exploited by criminals for illicit activities.

- Regulatory Environment: Understand the regulatory landscape in your jurisdiction and assess how well you're adhering to AML/CTF obligations

- Past Incidents: Reflect on any past instances of suspicious transactions or violations of AML/CTF regulations to identify areas for improvement.

Download our AML/CTF Fact Sheet

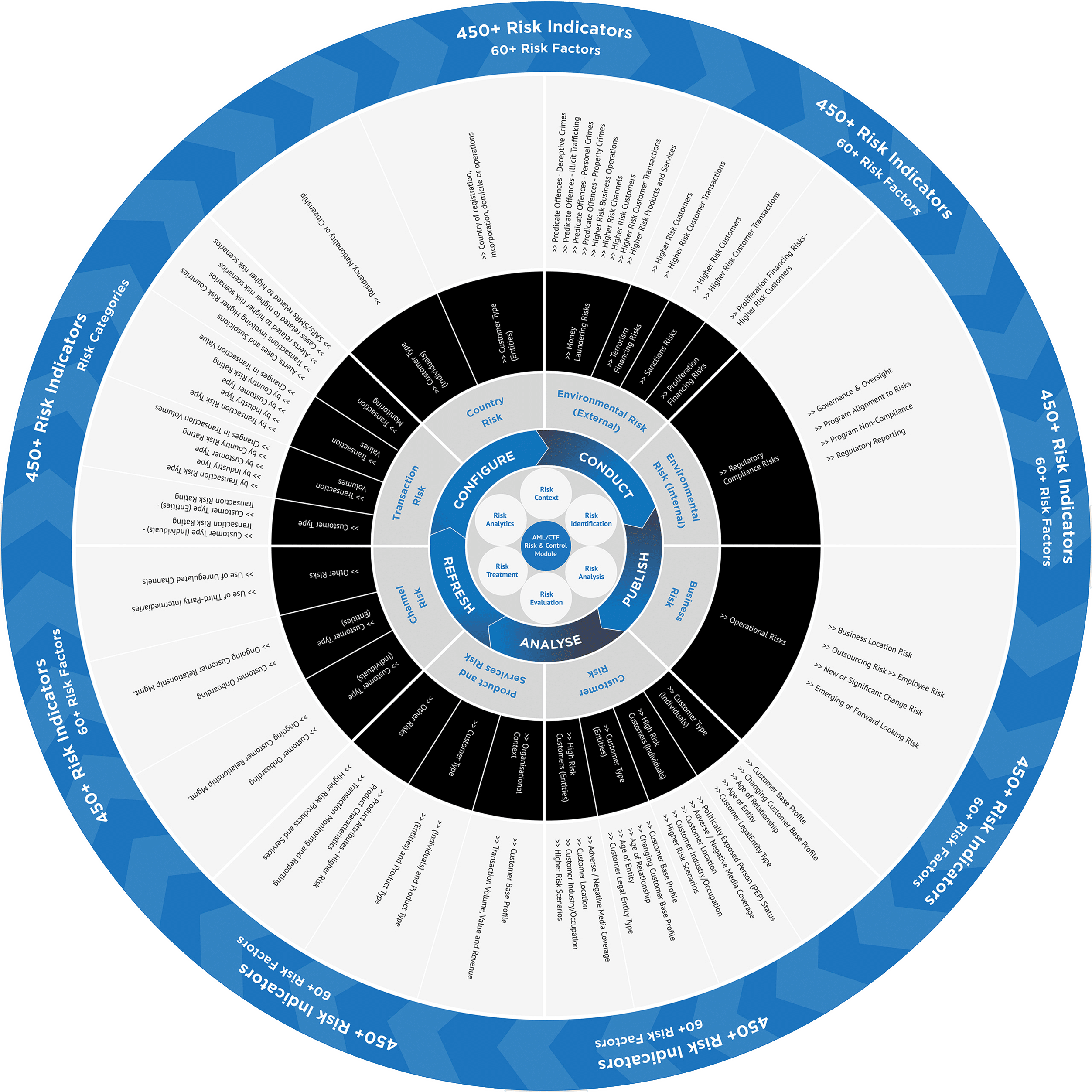

Download our Money Laundering and Terrorism Financing Risk and Control Module Brochure

Click on the button to download the AML/CTF Risk and Control Module Brochure

COMPLETE THE FORM

Access the Content Module Overview

The content module overview provides an introduction to anti-money laundering and counter-terrorism financing, and outlines the necessity and methods for its implementation.

Additionally, it presents the Arctic Intelligence Risk Assessment Platform, highlighting its potential advantages for your business.

Request your free copy now!