Designated services offered by

Trust and Company Service Providers

Under the AML/CTF Amendment Bill 2024, specific services provided by trust and company service providers will be designated as covered activities and will be subject to AML/CTF obligations. These services include:

These covered activities typically include:

If your business provides any of these services, it will be subject to AML/CTF obligations.

Money Laundering and Terrorism Financing (ML/TF)

Risks in the TCSP sector

Trust and company service providers face significant ML/TF risks, including:

- Concealment of Beneficial Ownership – Criminals exploit TCSPs to create complex corporate structures, trusts, and nominee arrangements that obscure the true owners of assets

- Use of Shell Companies – Establishing and managing companies with no legitimate business activity to launder illicit funds

- Nominee Director and Shareholder Services – Providing individuals to act as directors or shareholders, shielding criminals from detection

- Provision of Registered Office or Business Address – Enabling businesses to appear legitimate while concealing their true location or activities

- Trusts and Foundations for Asset Protection – Criminals use TCSPs to set up trusts or offshore foundations to hide illicit wealth and avoid detection

- Facilitating Cross-Border Transactions – Moving funds between jurisdictions with weak AML controls to avoid scrutiny

- Layering and Structuring Transactions – Transferring funds through multiple entities to obscure the origin and movement of illicit money

- Use of TCSP Services to Facilitate Tax Evasion – Structuring financial arrangements that enable the concealment of income or assets

- Providing Financial and Administrative Services Without Adequate Oversight – TCSPs may inadvertently assist in laundering funds if due diligence processes are weak or absent

- Exploitation of Regulatory Gaps – Criminals target TCSPs in jurisdictions with minimal AML/CTF oversight to move illicit funds undetected.

To comply with the AML/CTF Act by 1 July 2026, trust and company service providers must conduct a thorough ML/TF risk assessment to identify, mitigate, and manage risks effectively.

For more information on the ML/TF risks faced by TCSPs click here.

AML/CTF

Programs and Policies

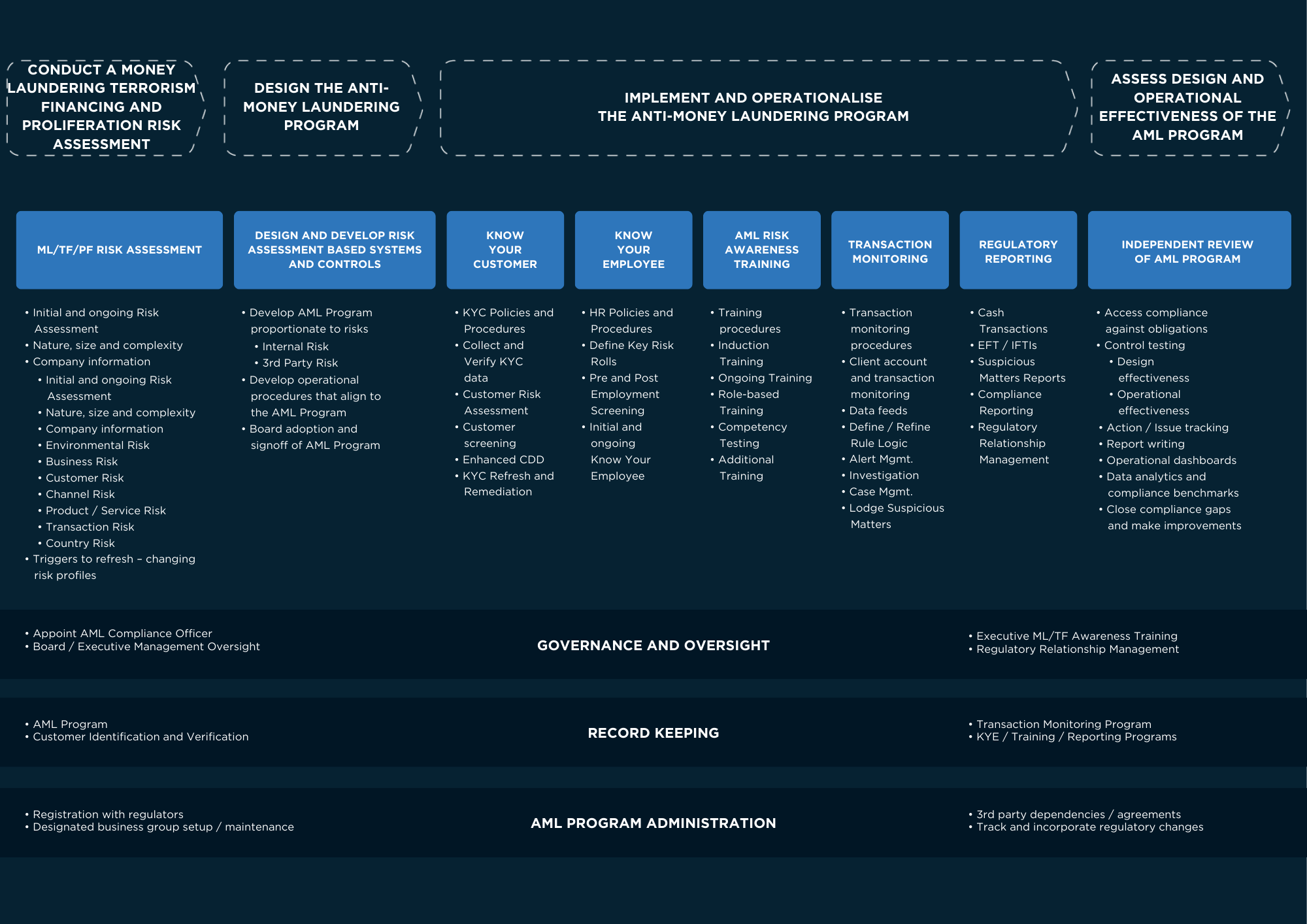

In addition to designing, executing and maintaining a money laundering, terrorism financing and proliferation financing (ML/TF/PF) risk assessment reporting entities are expected to implement AML/CTF policies that are both appropriate and proportionate to the identified risks, in order to mitigate and manage these risks.

The diagram below outlines at a high-level the other key pillars of an AML/CTF Program:

In addition to designing, executing and maintaining a money laundering, terrorism financing and proliferation financing (ML/TF/PF) risk assessment reporting entities are expected to implement AML/CTF policies that are both appropriate and proportionate to the identified risks, in order to mitigate and manage these risks.

In focus

Blogs

In focus

Whitepapers

Anti-Money Laundering 101: What do Australian Trust and Company Service Providers need to know about the AML/CTF Amendment Act 2024 and how can they start to prepare to comply?

Insights for providers.

Financial Crime Risk Assessment for TCSPs: Practical Steps

Guidance on financial crime risk assessment for TCSPs, outlining practical steps to identify, mitigate, and manage money laundering and compliance risks effectively.

How do organised criminals exploit trust and company service providers to launder the proceeds of their crimes and what can you do to prevent this happening in your business?

TCSPs and money laundering.

Case Studies: How organised criminals have exploited trust and company service providers to launder the proceeds of their crimes and how you can prevent this happening in your business

Prevent money laundering.