Designated services offered by

Accounting Professionals

Under the AML/CTF Amendment Bill 2024, specific accounting services will be designated as covered activities and will be subject to AML/CTF obligations. These services include:

If your business provides any of these services, it will be subject to AML/CTF obligations.

Money Laundering and Terrorism Financing (ML/TF)

Risks in the Accounting Profession

Accounting professionals face significant ML/TF risks, including:

- Misuse of Client Accounts – Criminals may exploit accountants’ client accounts to layer illicit funds, making transactions appear legitimate

- Obscuring Beneficial Ownership – Accountants can be used to set up shell companies, trusts, or complex corporate structures that conceal the true ownership of assets

- False Invoicing and Over/Under Reporting – Fraudulent invoices, inflated expenses, or manipulated financial statements can be used to legitimise illicit funds

- Tax Evasion and Fraudulent Tax Returns – Criminals may use accountants to create fraudulent tax schemes that obscure the origins of illicit funds

- Structuring and Layering Transactions – Splitting large transactions into smaller amounts to avoid detection or moving funds through multiple accounts to obscure the money trail

- Facilitating Real Estate Transactions – Advising or managing property transactions that criminals use to integrate illicit funds into the legitimate economy

- International Transactions and Offshore Structuring – Assisting in cross-border financial transfers, offshore accounts, or complex tax structures that criminals exploit to move and launder funds

- Providing Nominee Director or Shareholder Services – Acting as an intermediary to hide the true controllers of a business or financial transaction

- Use of Cash-Intensive Businesses – Assisting clients who operate in cash-heavy industries, which increases the risk of untraceable illicit funds being introduced into the financial system

- Limited Due Diligence and Compliance Weaknesses – Inadequate Know Your Customer (KYC) checks or failure to monitor transactions can result in accountants being unknowingly used to facilitate financial crime

To comply with the AML/CTF Act by 1 July 2026, accounting professionals must conduct a thorough ML/TF risk assessment to identify, mitigate, and manage risks effectively.

For more information on the ML/TF risks faced by Accounting Professionals, click here.

AML/CTF

Programs and Policies

In addition to designing, executing and maintaining a money laundering, terrorism financing and proliferation financing (ML/TF/PF) risk assessment reporting entities are expected to implement AML/CTF policies that are both appropriate and proportionate to the identified risks, in order to mitigate and manage these risks.

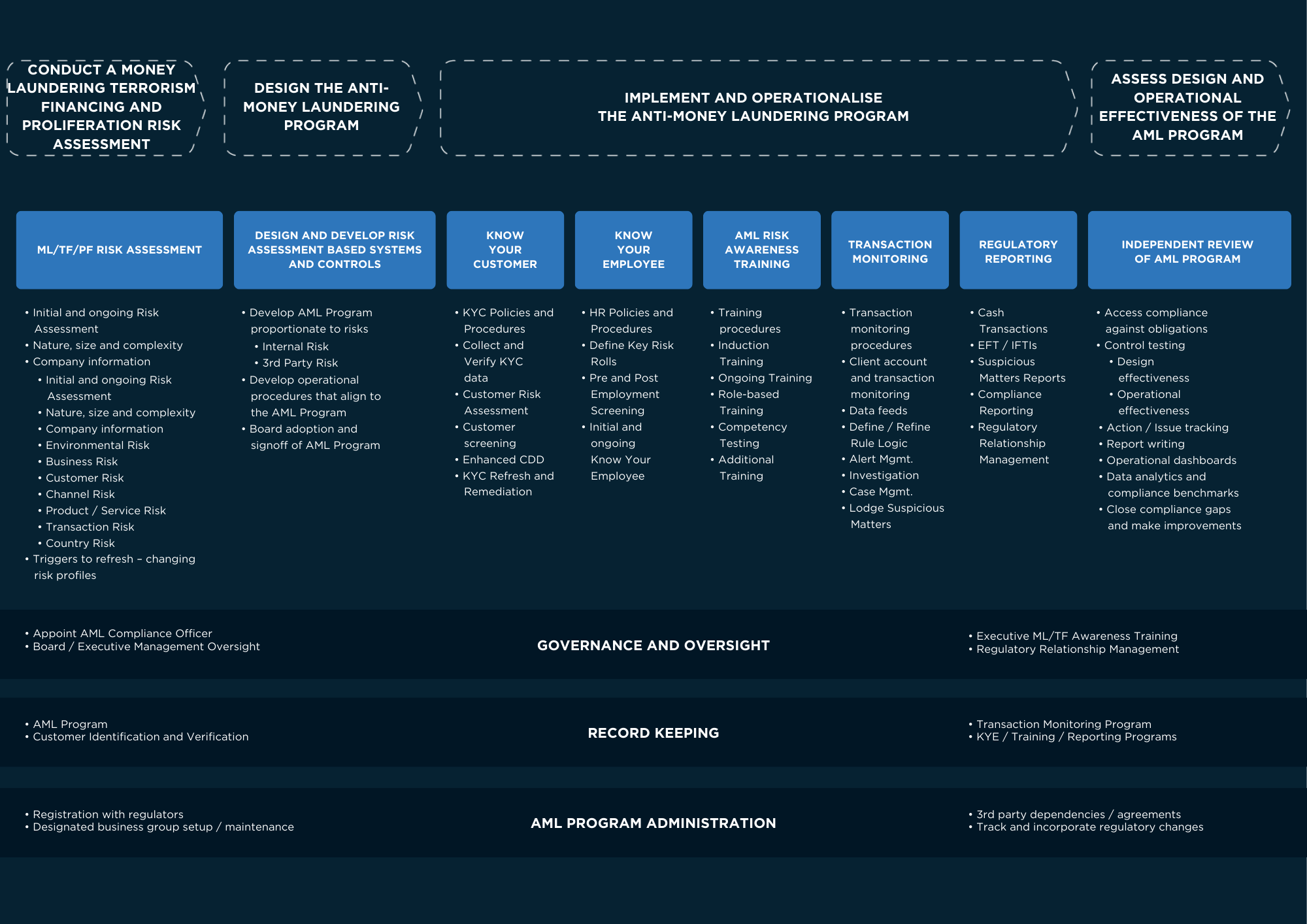

The diagram below outlines at a high-level the other key pillars of an AML/CTF Program:

In addition to designing, executing and maintaining a money laundering, terrorism financing and proliferation financing (ML/TF/PF) risk assessment reporting entities are expected to implement AML/CTF policies that are both appropriate and proportionate to the identified risks, in order to mitigate and manage these risks.

In focus

Blogs

In focus

Whitepapers

Anti-Money Laundering 101: What do Australian Accounting Professionals need to know about the AML/CTF Amendment Act 2024 and how can they start to prepare to comply?

Australian accountants must prepare for AML/CTF 2024 compliance requirements and obligations.

How Do Organised Criminals Exploit Accounting Professionals to Launder the Proceeds of Their Crimes and How You Can Prevent This Happening in Your Business

Learn how criminals exploit accountants for money laundering. Strong compliance prevents abuse.

Case Studies: How Organised Criminals Have Exploited Accounting Professionals to Launder the Proceeds of Their Crimes and How You Can Prevent This Happening in Your Business

Case studies show criminals exploiting accountants. Compliance helps prevent laundering.