HOW

Pervasive is Tax Evasion?

In 2016, the International Consortium of International Journalists (ICIJ), exposed international tax evasion of unprecedented proportions in the Panama Papers, a giant leak of more that 11.5 million financial and legal records, exposing industrial tax evasion enabling crime, corruption and tax evasion to occur through secretive offshore companies including banks and trust and company service providers, professionally enabled by lawyers and accountants.

In 2017, the ICIJ along with 95 media partners, led a global investigation into the offshore activities of some of the world’s most powerful people and companies, based on 13.4 million leaked files from a combination of offshore service providers and company registers of some of the world’s most secretive countries leading to the publishing of the Paradise Papers.

The Panama Papers and Paradise Papers leaks, in particular, brought to light the enormous scale of illicit financial activities aimed at evading taxes and maintaining anonymity. These scandals exposed extensive offshore tax evasion and financial secrecy practices orchestrated by multinational corporations, high-net-worth individuals, and even monarchies. Such revelations underscored the significant role played by "gatekeeper professions" such as accountants, lawyers, and trust and company service providers in facilitating these schemes, often across multiple jurisdictions through the pervasive use of complex company and trust structures to conceal assets and income from tax authorities worldwide. These revelations and other investigations resulted in widespread public outrage that intensified pressure on Governments to take decisive action against tax evasion.

WHAT IS

Anti-Facilitation of Tax Evasion?

In response to high-profile international tax scandals, Governments and International Organisations, like the OECD, United Nations, FATF, Transparency International, the European Commission and the Tax Justice Network, have implemented stringent “Anti-Facilitation of Tax Evasion” laws and initiatives to combat tax evasion on a global scale.

Anti-Facilitation of Tax Evasion measures play a crucial role in mitigating tax evasion by ensuring that financial institutions and gatekeeper professions do not facilitate or turn a blind eye to individuals or organisations engaged in illegal tax evasion schemes.

These measures target sectors like financial services, legal services, company and trust service providers and the accounting profession and are essential for upholding the integrity of financial systems and maintaining public trust. By enforcing rigorous standards and penalties for facilitators of tax evasion, governments and regulatory bodies aim to promote a fair and transparent tax environment where all participants contribute equitably to societal welfare and economic stability.

By fostering greater transparency and accountability, these measures seek to curb illicit financial flows and ensure that all taxpayers contribute equitably to national revenues and global economic stability.

WHAT IS AN

Anti-Facilitation of Tax Evasion Risk Assessment?

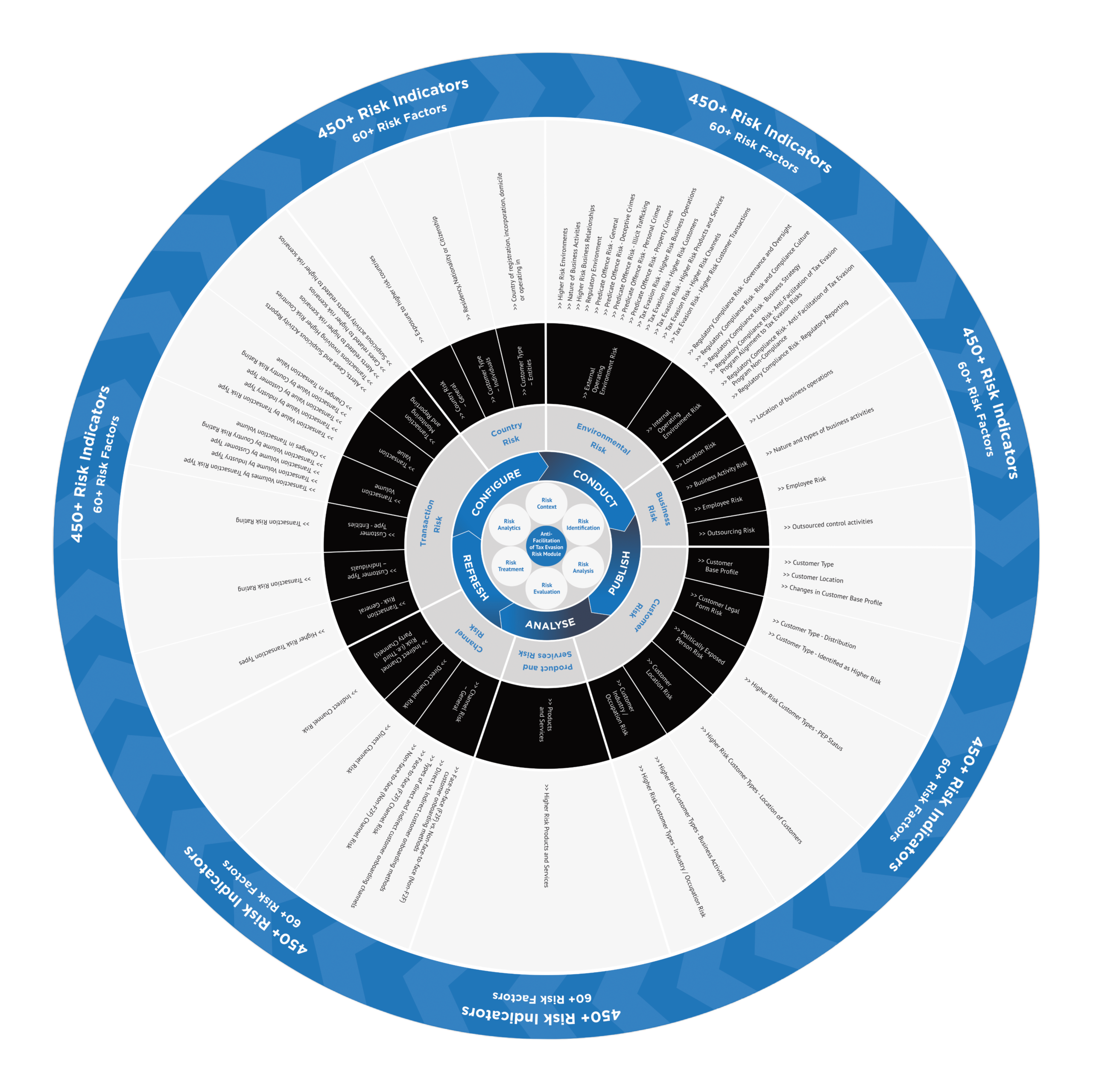

An Anti-Facilitation of Tax Evasion Risk Assessment is a systematic process that helps organisations operating in these sectors, to identify and assess the potential risks and vulnerabilities to being wittingly or unwittingly involved in tax evasion schemes and helps them to assess both the design and operational effectiveness of their control frameworks, to ensure that tax evasion risks are mitigated and managed, in a way that is both appropriate and proportionate to the nature, size and complexity of the organisation.

The primary objective of conducting an Anti-Facilitation of Tax Evasion Risk Assessment is to ensure compliance with tax laws and regulations, as well as minimising the likelihood and impact of tax evasion, by ensuring a highly effective control framework is designed, implemented and maintained to help organisations to minimise and mitigate against tax evasion risks.

Who must or should conduct an

Anti-Facilitation of Tax Evasion Risk Assessment?

There are millions or organisations across a diverse array of industry sectors that may be exposed to tax evasion compliance risks including Financial Institutions, Large Corporates, Professional Service Providers, Small and Medium-Sized Enterprises, Family Offices, as well as, High-Net Worth Individuals, that should consider conducting a tax evasion risk assessment.

This group represents millions of organisation and entities and can be broken down as follows:

WHY

Should you consider conducting an Anti-Facilitation of Tax Evasion Risk Assessment?

There are many reasons why entities and high-net-worth individuals should consider conducting a tax evasion risk assessment including:

- Compliance with Regulations - Many jurisdictions require businesses to identify, assess, mitigate and manage tax evasion risks to comply with legal and regulatory frameworks. This helps avoid fines, penalties, and legal repercussions.

- Reputation Management - Engaging in or being associated with tax evasion schemes can severely damage your businesses reputation. Conducting a risk assessment demonstrates a commitment to ethical practices and transparency.

- Financial Security - Identifying and addressing tax evasion risks can prevent potential financial losses due to fines, back taxes, and interest payments, helping to ensure your businesses financial stability.

- Operational Efficiency - Understanding tax evasion risks allows your business to streamline its operations, ensuring that all financial activities are in line with tax laws and regulations, thereby avoiding unnecessary disruptions.

- Stakeholder Confidence—Investors, partners, and customers are more likely to trust and engage with businesses that actively mitigate and manage tax evasion risks.