Newsletter – 01 September 2019

What we’re hearing…

Over the last month we have seen a fair bit of activity from the Australian Government and AUSTRAC in the run up to the follow-up mutual evaluation visit by the Financial Action Task Force (FATF), which is expected to start in November.

The cynics among us could be forgiven for asking, why the last minute burst of activity when you have had the last 5 years to get your house in order?

On the 12th August, the Australian Government closed the consultation process related to the Currency (Restrictions on the Use of Cash) Bill 2019, which proposes a blanket ban on businesses accepting cash over AUD$10,000, with the prospect of two-years in jail and a $25,000 fine for businesses with an ABN accepting cash. This seems to be a knee-jerk reaction and is unlikely to substantially reduce the risk of money laundering through high-value dealers and given the timing, seems to be an ill-considered plan to avoid having to regulate high-value dealers under the AML/CTF Act.

Criminals laundering funds through high-value dealers only need to open an account at a luxury goods dealer, wire in funds to their account, visit another branch in an overseas location, buy an expensive watch and get a clean cheque for the balance into an overseas account – hey presto, clean funds!

So will this bill reduce the money laundering risk through high-value dealers?

I seriously doubt it…

We have also seen AUSTRAC’s CEO, Nicole Rose in the papers talking about the “flood of self-disclosures” of breaches of the AML/CTF laws, since CBA’s fine, increased focus following the Royal Commission and the annual compliance report giving reporting entities cause to pause and reflect.

This raises some alarm bells and lots of questions about the effectiveness of the AML/CTF regime in Australia:

What action is AUSTRAC actually going to take in response to breaches of AML laws?

How long have these self-disclosed breaches been festering away for, and have the underlying lax systems, procedures and controls been fixed?

Why is there still no mandatory independent review requirement in Australia and if there had been 13 years ago when the AML/CTF Act 2006 was enacted would we be seeing such widespread non-compliance?

How is Australia going to handle the next FATF visit when it is clear there is widespread non-compliance, regular money laundering scandals at Australia’s most systemically important regulated entities, high-levels of apathy and virtually no progress on AUSTRAC’s commitment to the 84 recommendations following the last FATF visit?

– Anthony Quinn, CEO and Founder, Arctic Intelligence

News in brief

AUSTRAC CEO Nicole Rose PSM opened the 22nd Asia/Pacific Group on Money Laundering annual meeting on 20th August. 41 countries met in Canberra to discuss money laundering methods, and work to disrupt money laundering, terrorist financing and proliferation financing. Learn more.

Australians could face two-year jail sentences and fines of up to $25,200 under proposed laws that limit the use of cash to $10,000. An exposure draft of the legislation, called the Currency (Restrictions on the Use of Cash) Bill 2019, was quietly introduced by Treasurer Josh Frydenberg last month. Read more

AUSTRAC flags tough action after being ‘flooded’ with money laundering breaches and warns it is likely to take more action against Australia’s top financial institutions. Read more

The Reserve Bank of New Zealand (RBNZ) formally communicates its reduced tolerance for Reporting Entities’ breaches and deficiencies to meet the AML/CFT ACT 2009. RBNZ clearly stated their appetite for taking formal enforcement action following breaches will increase on 1st September 2019. Read more

Britain’s biggest bookmaker, Ladbrokes Coral, has been hit with a £5.9m fine to protect customers and prevent money laundering. Gamblers were allowed to deposit large sums over a number of years despite clear warning signs they may have been using stolen funds. Learn more

The latest from Arctic insights

To browse our full catalog of articles, press releases, case studies and interviews click here.

Arctic Intelligence – winner of the RegTech Start-Up of the Year award at the fourth annual FinTech Awards 2019.

The award was given to Arctic Intelligence in recognition of its industry-leading risk assessment and compliance solutions, designed to assist regulated businesses in meeting their anti-money laundering compliance obligations. Read more

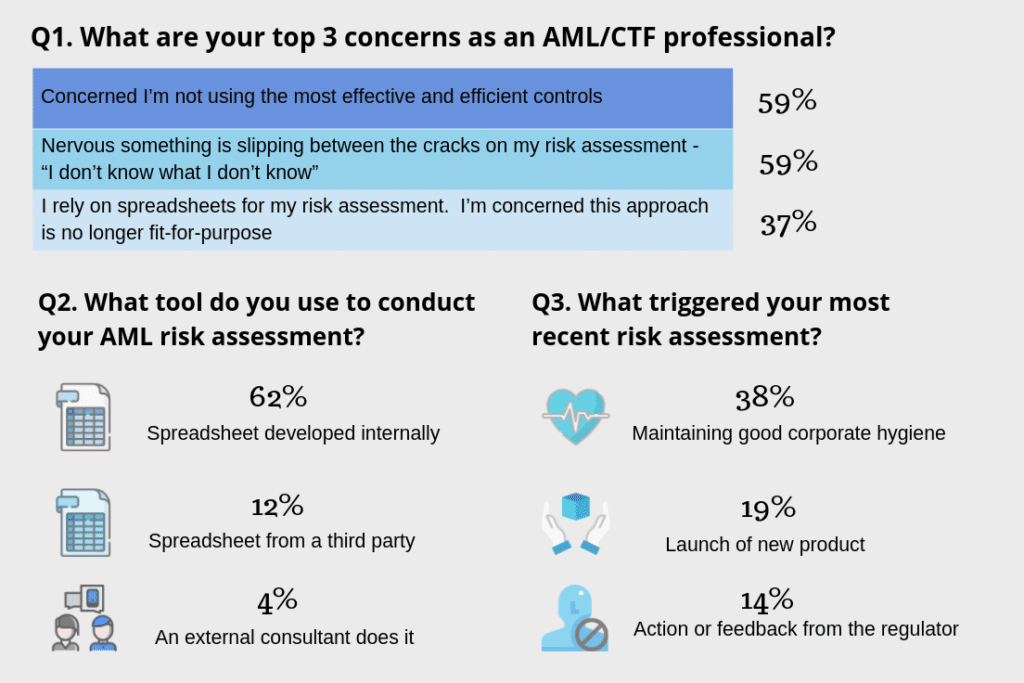

Polling results from webinar “Hear Garry Clement’s views on the importance of automating AML risk assessments”

AML/CTF professionals from seven countries joined the webinar and shared opinions. Do you share the same AML views as attendees at our recent webinar?

If you missed the webinar, you can watch the recording here.

Contact us to find out how Arctic Intelligence helps deliver explainable and defendable ML/TF risks assessments.

FREE AML Pulse Check

Is your AML/CTF Program in good shape?

Does your program have weaknesses and gaps?

Take our FREE self-assessment today to find out!?

Upcoming event

ACAMS Annual Conference: Las Vegas, USA, 23-25 September 2019

We’re excited to be exhibiting at the ACAMS 18th Annual AML & Financial Crime Conference in Las Vegas. If you’re planning to attend, please stop by our booth #810 and say Hi.

If you’d like to book a demo pre, post, or during either conference, please email [email protected].

Subscribe to our monthly newsletter today