What is fraud?

In criminal law, a fraud is an intentional deception made for personal gain or to damage another individual; the related adjective is fraudulent. The specific legal definition varies by legal jurisdiction. Fraud is a crime, and also a civil law violation.

What are the different types of fraud?

The main types of fraud includes:

- Cyber crime – phishing, spoofing, spam emails, malware, spyware & click fraud

- Identity theft – physical theft of mail, telephone and online ID theft

- Credit and debit card fraud – stolen cards, skimming and counterfeiting

- Cheque fraud – stolen cheques, tampering cheques and counterfeiting

- Mortgage fraud – falsifying information and defaulting on loans

- Employee fraud – physical theft, misappropriation of funds and false accounting

- Scams and deceptions – ponzi schemes, pyramid schemes and advanced fee fraud among many others

What is the size of the fraud problem?

The exact size of the fraud problem is impossible to estimate but on a global scale would be trillions of dollars every year.

In 2012, the Annual Fraud Indicator estimated the fraud losses from the UK alone each year totalled £73 billion, from the Private Sector (£45.5bn), Public Sector (£20.3bn), Individuals (£6.1bn) and Not-for-profit (£1.1bn). In a 2003, report by the Australian Institute of Criminology (AIC) and PwC entitled “Serious Fraud in Australia and New Zealand” annual fraud losses were estimated at AUD$5.8bn, which is increasing year on year.

Each year, the Big 4 consulting firms publish their own Global Fraud Survey findings which not only provide estimates into fraud losses but also highlights concerns and fraud trends across 30+ countries by conducting in-depth interviews with key stakeholders.

Understanding the main types of fraud and the actions your organisation can take to protect themselves from the rising costs of fraud, such as developing an effective Fraud Risk Management Framework is essential to counter fraud risks.

Further resources

Why not subscribe to the fraud daily digest and keep up to date with the latest developments.

UNDERSTANDING

Fraud

Fraud has been around for centuries dating back to 300 B.C., when a Greek merchant called Hegestratos, concocted a plan to sink a barge loaded with corn and collect an insurance claim, but drowned in the process!

Even before money was invented, when merchants used to barter with each other for commodities, opportunists would take advantage of the fact that it is hard to keep track of quantities and misrepresent these to take advantage for their own benefit.

Since money became a recognised mechanism for transferring value there has been a long and chequered history of fraud, counterfeiting and other schemes and scams, including the first recorded Ponzi scheme uncovered in 1920 after an Italian immigrant, Charles Ponzi, collected about $20 million ($230m in today’s money).

Ninety years later in 2008, Bernie Madoff, a stockbroker and investment adviser, as well as, the former non-executive chairman of the NASDAQ was convicted of running the world’s largest Ponzi scheme, which has been estimated to have involved $65 billion. In March 2009, Madoff pleaded guilty to 11 federal felonies and received 150 years in prison, the maximum allowed.

Fast forward to today, the pace of fraud is unprecedented with fraudsters and cybercriminals scamming individuals, companies and governments out of billions of dollars every year in more sophisticated schemes including massive data breaches involving stealing the credit card details of hundreds of millions of customers.

For more information on Fraud visit our resource centre

What is the impact of fraud?

According to the Association of Certified Fraud Examiners (ACFE)*,5% of revenues of a typical organisation is lost to fraud each year – which if applied to the Gross World Product translates to a projected global fraud loss of $3.25 trillion each year.

Fraud perpetrators continue to develop more inventive schemes and an equally sophisticated response is required to protect your organisation from the risk of fraud

Developing an effective fraud risk management framework to identify, assess, mitigate and manage risks is a critical step in reducing fraud losses and other associated consequences

*2012 Report to Nations survey

What are the consequences of failing to comply with AML/CFT laws?

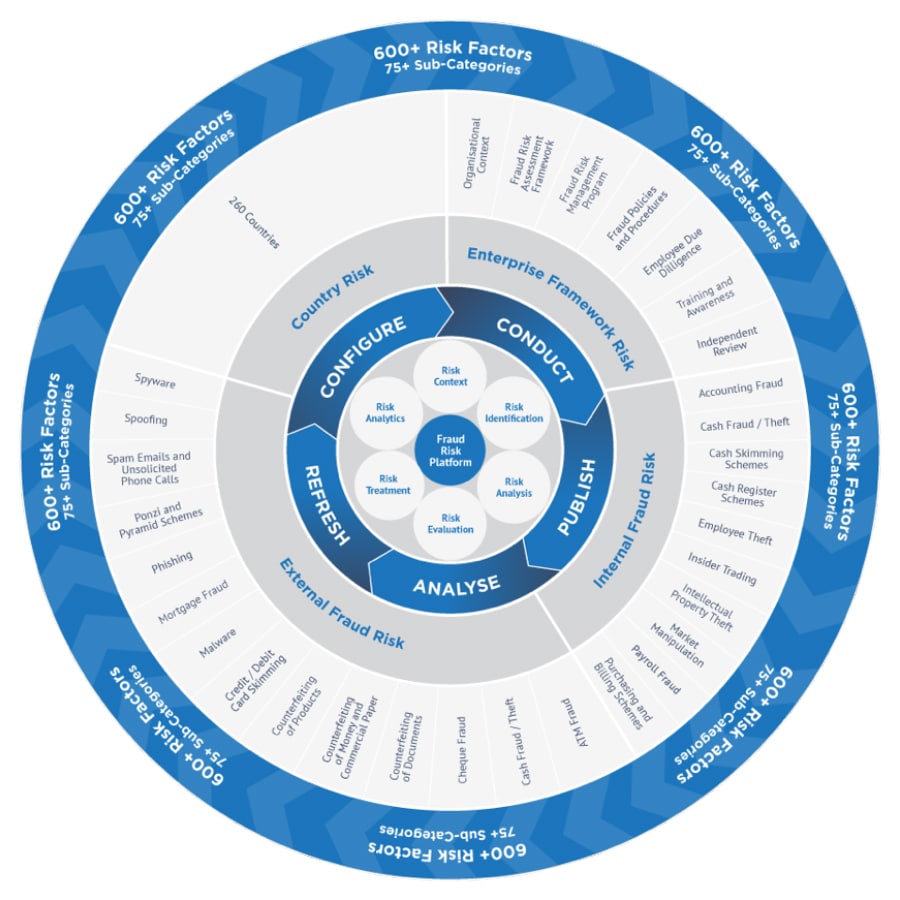

The diagram below sets out the components required to effectively manage the threat of fraud in your organisation.

Designing, implementing and operating an effective fraud risk management program can be a complex undertaking and presents a significant challenge to most businesses.

Do you know how to spot fraud vulnerabilities in your business?

What solutions do we offer?

Arctic Intelligence is a RegTech business that enables audit, risk and compliance ‘as-a-service’ through technology allowing our solutions to guide you to compliance.

Risk Assessments

In order to manage fraud risk exposure, it is critical that organisations develop a detailed understanding of the internal and external threats and develop mitigating systems, procedures and controls to reduce their risk exposure.

Arctic Intelligence has developed a Risk Assessment platform for identifying, assessing, mitigating and manage fraud risk exposures across the main categories of risk, including:

- Enterprise

- Internal

- External

- Country

The diagram below, depicts how the Arctic Intelligence Risk Assessment Platform can help your business manage fraud risk exposures.

The Risk Assessment Platform is designed to help you to identify, assess, mitigate and manage risks for financial crime and other risk domains.

The platform is highly configurable allowing you either purchase a content library or to create or upload your own risks and controls, as well as, change the risk methodology and risk weightings across the model and align the assessment to your risk management framework.