What is money laundering?

‘Money laundering’ describes the way some criminals use the legitimate financial system to try to hide or disguise the proceeds of crimes. Money laundering enables criminals to frustrate attempts to prosecute them or to recover the illegal gains of their crimes by distancing themselves and the money from the criminal activity that generated them. It also enables criminals to use the money for future criminal activity or in legitimate business.

What are the core requirements of an Anti-Money Laundering program?

The Financial Action Task Force (FATF) currently comprises 190+ country members representing most major financial centres in all parts of the globe.

FATF has developed recommendations on money laundering and terrorism financing that member countries have committed to adopt. FATF assesses each member country against these recommendations in published reports. Countries seen as not being sufficiently compliant with such recommendations are subjected to financial sanctions.

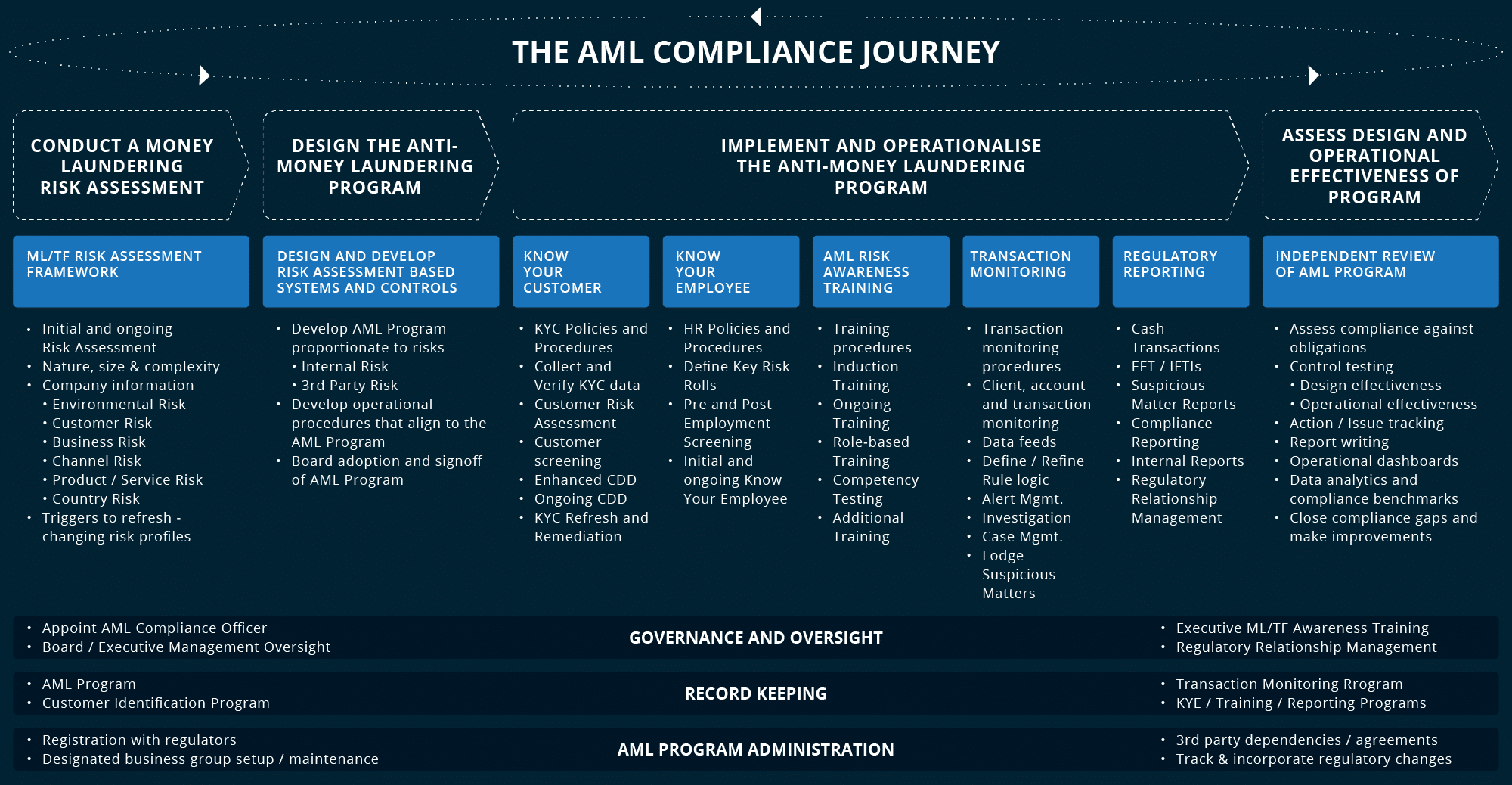

The core components of most AML/CFT Programs includes:

- Customer Identification / Know Your Customer (KYC)

- Enhanced Customer Due Diligence (ECDD)

- Know Your Employee (KYE) / Employment Screening

- Ongoing Customer Due Diligence (OCDD)

- Transaction Monitoring Program (TMP)

- Board and Senior Management Oversight

- Independent Review

- Staff Awareness Training

- AML Programs and Policy

Further resources

Why not subscribe to the Anti-Money Laundering daily digest or the Sanctions daily digest and keep up to date with the latest developments.

Key AML obligations and how our AML solutions help you meet them

Designing, implementing and operating an AML Program is a detailed and complex undertaking and presents a significant challenge to most businesses.

The diagram below sets out the major requirements that all regulated businesses must meet to be compliant with AML laws.

What are the consequences of failing to comply with AML CTF laws?

It has been estimated that over USD$400 billion dollars* has been paid in fines by financial institutions since 2008 for failing to comply with AML laws, highlighting the importance of implementing the right cost effective solutions to ensure AML compliance.

In addition to fines and penalties imposed by the AML CTF regulator, the consequences for non-compliance are far-reaching and could include:

- Civil and/or criminal penalties imposed on Boards and Senior Executives;

- Enforceable undertakings to act or cease acting in a certain way;

- Reputation damage resulting from negative media exposure;

- Revocation of operating licenses;

- Falling share prices; and

- Extensive remediation programs to address compliance deficiencies.

* Source: Thomson Reuters

What AML solutions do we offer?

Arctic Intelligence is a RegTech business that enables audit, risk and compliance ‘as-a-service’ through technology, allowing our solutions to guide you to compliance.

Risk Assessments - requirements of a robust AML solution

Regulated businesses must conduct an initial and ongoing risk assessment that considers the following categories of risk:

- Customer

- Business

- Product and Service

- Channel

- Country

The money laundering and terrorism financing risk assessment must be logical, well documented and defendable to your AML regulator.

Conducting money laundering and terrorism financing risk assessments and identifying controls that can mitigate and manage these risks continues to provide significant challenges to many regulated businesses, which led to our focus on our risk assessment platforms.

Anti-Money Laundering solutions and Program Manuals

Having completed the money laundering and terrorism financing risk assessment, you are required to create and maintain an AML Program Manual documenting the systems, procedures and controls that you have in place to mitigate and manage the identified risks.

Documenting an AML Program Manual that is appropriate and proportionate to your risks, as well as containing all of the expected sections and content, to the level of detail expected by your AML regulator often presents a significant challenge for regulated businesses, which is why we developed the AML/CFT Program Manuals.

Our AML Accelerate platform contains an AML Program Manual that has been tailored to over 30 financial and industry sectors and to the AML laws of a number of countries.

This document provides a solid foundation for further modifying the content to suit your organisations specific circumstances.

AML Accelerate also provides an Action Plan and AML Operating Manual that provides guidance on how to practically implement and operationalise the content of the AML Program Manual.

AML Accelerate also monitors for regulatory changes and provides an alert notification service to ensure that your AML Program can be kept up-to-date as AML regulators make changes.

Our Anti-Money Laundering Health Check platform also contains an AML Program Manual that can be tailored to suit your organisations specific circumstances.

The AML Program Manual contained in the AML Health Check platform is not tailored to any specific industry sector or any AML laws of any specific country but has been included as an additional product feature for clients that are mostly interested in software that supports the independent review requirement.

Independent Review

Regulated businesses are required to have their AML Programs independently reviewed every 1-3 years, depending on local AML supervisory requirements.

The Anti-Money Laundering Health Check solution is an online platform dedicated to controls assurance.

It provides a structured framework for conducting independent reviews to assess the design and operational effectiveness of anti-money laundering and counter terrorism financing programs.

The AML Health Check is typically used to perform:

- An internal self-assessment against regulatory AML CTF obligations;

- An assessment of a third-party for due diligence purposes;

- Independent reviews by internal audit functions of the major reporting entity;

- Independent reviews / gap assessments performed by AML consultants; and

- Remediation programs to track improvements against regulations.

The Anti-Money Laundering Health Check platform has been designed to leverage best practices in AML risk management controls assurance.

It was built based on a logical hierarchy that links rules and obligations together with policies, risks and controls. This provides a means of assessing compliance against obligations, prioritising responses, providing auditor comments and management responses, as well as assigning actions and attaching documentary evidence to support audit findings.

After the assessment has been completed for each compliance obligation users can create executive summary reports directly from the platform, highlighting the key observations, findings and recommendations, as well as actions, issues and risks identified during the review process.

The AML Health Check platform also contains rich data analytics that provide actionable business intelligence including; real-time operational dashboards for tracking open and outstanding actions, issues and risks; interactive reports which can slice and dice audit data in many ways including, drilling into particular areas of interest, as well as benchmarking audit outcomes across different timeframes, divisions and countries, it can even summarise on a single page the compliance status across hundreds of AML compliance obligations.